It’s a sign of how certainly Athena Home loans philosophy the 3rd-class channel it co-designed the this new mortgage choices together with home loans.

Athena circulated the brand new package out of Customized lending options, which includes Care about-Operating Lite Doctor and 80 85% No LMI, with the Monday.

This new low-lender lender said they will deliver unequaled representative and avoid customer experience, scaled with faithful BDM options and you will borrowing from the bank teams having fast workshopping.

Ahena national BDM specialised products Stephane Feuillye (pictured a lot more than left) told you the company recognised the critical importance of agents in the mortgage industry.

Agents share an incredibly comparable objective to help you Athena in this it can be found to offer the greatest outcome and you can experience to have consumers, Feuillye said. So it aligns thus closely having Athena’s mission to improve home loans for good. Mode brokers up to achieve your goals was fundamentally vital that you Athena.

Feuillye told you this was why Athena was enthusiastic about deep partnerships in which it co-developed the device and service skills they needed, and those that the people called for.

I co-tailored our Tailored unit experience in person having brokers to transmit with the the underserved demands associated with higher level debtor cohort, said Athena President and you can co-inventor Nathan Walsh (pictured a lot more than best).

Tailored funds to have borrowers

Also the Self-Functioning Lite Doc and you will 80% – 85% Zero LMI, that are now available, Athena is even introducing a non-Sheer Persons and you may Trusts unit for the Sep.

These items might possibly be given to agents by way of several aggregators the fresh light identity Mortgage Possibilities Liberty Designed assortment, and also to loans Vilas LMG through Athena Designed.

Feuillye told you Notice-Operating Lite Doc was designed to have consumers into the an effective monetary standing however, exactly who required some autonomy within paperwork they’d to incorporate.

Like, rooms their taxation return is not lined up in order to after they should make a proceed casing finance, the guy told you.

The principles offer versatile income verification, and you can our wide product range entails they don’t have to check out one lender to own a beneficial lite doc product after which go someplace additional and you may look at the entire process once again after he’s happy to move to full doctor.

An alternative trick element told because of the representative co-framework are Tailored’s personalised pricing. Feuillye told you this accepted that not all entrepreneurs was indeed the exact same. You should be pretty rewarding consumers because of their business assistance which have a performance you to definitely shows the problem.

Tailored’s 80 85% Zero LMI services served an effective individuals whom commonly got dollars fastened up various other opportunities and you may failed to want to delay getting into industry or wanted additional liberty without the cost of LMI.

Feuillye told you when launched inside the Sep, the latest low-exchange trusts and you may organizations device would offer a remedy for people and you can thinking-operating consumers shopping for a sophisticated solution to framework their house expenditures.

A complete collection also provides all of our steeped provides: breaks, offsets, multi-guarantee and you will an abundant digital experience with the fresh cellular app. This can be supported by higher prices and you may pricing, along with finest in sector SLAs and broker support, he said.

Broker views assisted Athena

Walsh told you a significant part of Athena’s proposal and one off the newest keys to the fresh success it was experience having its aggregator people is a persistent method of hearing broker viewpoints.

Delivering one opinion what’s great, in which will there be try to perform, in which may be the potential to adopt how exactly we does anything differently, said Walsh.

There’s a keen underserved segment out-of investors and mind-functioning borrowers who need a great deal more freedom regarding their financials, as well as need a fully searched unit.

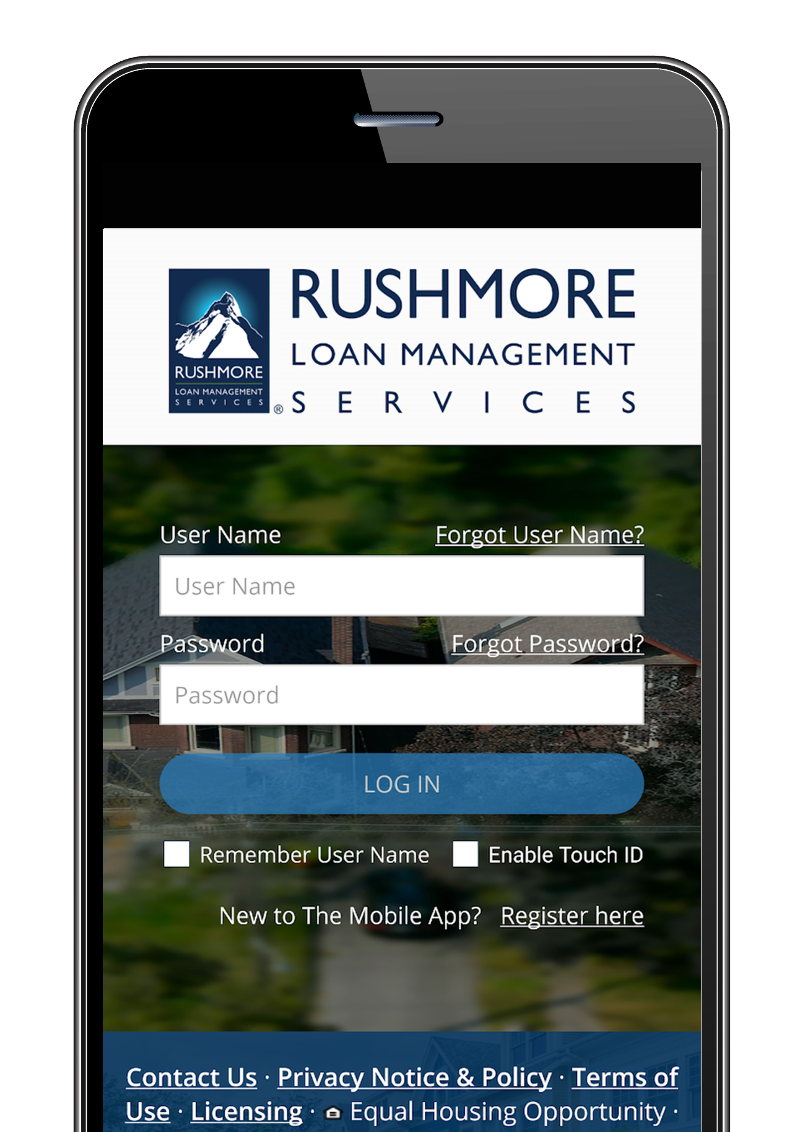

After you take a look at extremely customized factors being offered, he could be pretty earliest, while these materials will provide splits, offsets, multi-guarantee and you will a rich electronic expertise in the fresh new mobile app.

Boost getting BDM and you will credit groups

Athena comes with reinforced their BDM and you will borrowing organizations with the brand new uses. Walsh said which had extra substantial expertise in advanced level financing situations.

We have been committed to keeping all of our history of usage of, precision and you can price around the those two groups. The original scale within these groups might possibly be monitored aimed to regularity and we will continue steadily to make as needed.

I was supporting brokers to enhance their people to possess the majority of my personal 20+ seasons profession in home finance, Feuillye said. Being able to accomplish that at the Athena … is an activity I am really thinking about.

Athena to your progress trajectory

New non-lender fintech is based within the from the Walsh and you can co-founder Michael Starkey having a purpose to alter mortgage brokers once and for all.

1st, our very own attention is actually on the perfect proprietor occupier and you will investor areas; along with the individuals factors securely during the business, the time had come to respond to another options, Walsh said. I consulted that have agents extensively in order to dimensions men and women segments on the better you desire, and you can identified Customized once the 2nd area of focus.

Up until now, Athena provides compensated $7.5 billion financing and all of the products it makes is noted on serviceability aggregator Quickli, recognising the importance of that it broker device.

Starkey said Athena went on so you’re able to notch up number RMBS financial support, since noticed in March on $1bn Olympus deal. He said which effects are from the right back off strong investor need for securitised financial obligation, combined with new business’ increases as a result of quality financing.

At the each other a buyers and a market top, i have worried about building a business having a credibility having prioritising openness, equity and you will integrity to deliver powerful worth, said Starkey.

The fact we also have good variety in the investment at the a funds top with financing away from biggest local and you can overseas financial institutions stands for the general reputation of our own organization on the market.